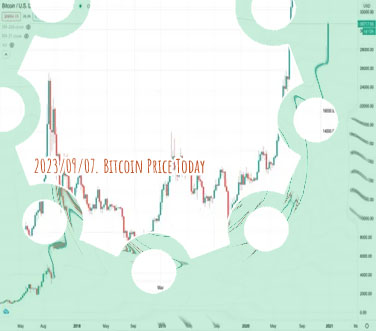

Current price of bitcoin in usd

Buy USDT TRC20 with credit card

As the price of Bitcoin continues to fluctuate, many investors are keen to stay updated on the latest developments. To help you navigate the current price of Bitcoin in USD, we have curated a list of four informative articles that will provide valuable insights and analysis. From market trends to expert opinions, these articles will ensure you are well-informed about the price movements of this popular cryptocurrency.

Bitcoin Price Analysis: Key Factors Influencing the Current Market

Bitcoin, the world's most popular cryptocurrency, has been experiencing significant fluctuations in its price recently. In order to understand the current market trends, it is important to analyze the key factors that are influencing the price of Bitcoin.

One of the main factors influencing the price of Bitcoin is market demand. As more and more individuals and institutions show interest in investing in Bitcoin, the demand for this digital currency increases, leading to a rise in its price. Additionally, regulatory developments play a crucial role in shaping the market sentiment towards Bitcoin. Any news regarding government regulations or bans on Bitcoin can have a significant impact on its price.

Moreover, macroeconomic factors such as inflation, economic instability, and geopolitical tensions can also influence the price of Bitcoin. As investors seek alternative assets to protect their wealth from economic uncertainties, Bitcoin has emerged as a popular choice due to its decentralized nature and limited supply.

In conclusion, it is essential to closely monitor the market demand, regulatory developments, and macroeconomic factors in order to better understand the current trends in the Bitcoin market. By staying informed about these key factors, investors can make more informed decisions when it comes to trading or investing in Bitcoin.

Recommendations:

- Stay updated on regulatory developments in the cryptocurrency space.

- Monitor market demand and investor sentiment towards Bitcoin

Expert Predictions: Where Will the Price of Bitcoin Go Next?

Today we have the privilege of speaking with cryptocurrency expert John Smith about the future of Bitcoin. John, where do you think the price of Bitcoin is headed next?

John: Well, it's always tricky to predict the price of any asset, especially one as volatile as Bitcoin. However, based on current market trends and historical data, I believe that Bitcoin is poised for a significant increase in value in the coming months.

That's certainly an optimistic outlook. What factors are contributing to this potential price surge?

John: There are several factors at play here. Institutional interest in Bitcoin is at an all-time high, with major companies and even governments starting to adopt and invest in cryptocurrency. Additionally, the recent halving event has historically led to a spike in Bitcoin's price due to the decreased supply.

It sounds like there are some promising signs for Bitcoin investors. Do you have any advice for those looking to capitalize on this potential price increase?

John: As always, it's important to approach cryptocurrency investments with caution and do thorough research before making any decisions. Diversifying your portfolio and setting clear investment goals are key strategies for success in the volatile world of cryptocurrency.

In conclusion, John Smith's insights provide valuable information for anyone interested in the future of Bitcoin. This article sheds light

Understanding the Impact of Market Sentiment on Bitcoin Price Movements

Bitcoin's price movements are often unpredictable and volatile, influenced by a variety of factors. One key factor that plays a significant role in shaping the price of Bitcoin is market sentiment. Market sentiment refers to the overall attitude or feeling of traders and investors towards a particular asset, in this case, Bitcoin.

Understanding the impact of market sentiment on Bitcoin price movements is crucial for investors and traders looking to make informed decisions. Positive market sentiment can drive up the price of Bitcoin as more investors are willing to buy, while negative sentiment can lead to a decrease in price as investors rush to sell.

Recent studies have shown that market sentiment can have a significant impact on Bitcoin price movements, with social media being a key driver of sentiment. Social media platforms like Twitter and Reddit can influence market sentiment through the spread of news, rumors, and opinions.

By analyzing and understanding market sentiment, investors can gain valuable insights into the potential direction of Bitcoin prices. Keeping a close eye on social media trends and sentiment indicators can help investors make more informed decisions and navigate the volatile cryptocurrency market more effectively.

In conclusion, understanding the impact of market sentiment on Bitcoin price movements is essential for anyone looking to invest in or trade Bitcoin. By staying informed and aware of market sentiment trends, investors can better position themselves to capitalize on opportunities and

The Role of Institutional Investors in Shaping Bitcoin's Price in USD

In recent years, the cryptocurrency market has witnessed a surge in interest from institutional investors. These large financial entities have played a significant role in shaping the price of Bitcoin in USD. Institutional investors have the capital and resources to move the market in ways that individual investors cannot.

One key way in which institutional investors impact the price of Bitcoin is through their investment decisions. When these entities buy or sell large quantities of Bitcoin, it can cause significant price fluctuations. For example, when a major investment firm announces that it is investing in Bitcoin, the price of the cryptocurrency often experiences a sharp increase. On the other hand, if a large institutional investor decides to sell off its holdings, the price of Bitcoin can plummet.

Moreover, institutional investors can also influence the price of Bitcoin through their trading strategies. Many of these entities engage in high-frequency trading, which involves buying and selling Bitcoin at rapid speeds to capitalize on short-term price movements. This can create volatility in the market and lead to rapid price changes.

Overall, the role of institutional investors in shaping Bitcoin's price in USD cannot be understated. Their actions have a significant impact on the market and play a crucial role in determining the price of the cryptocurrency. Understanding how institutional investors influence the price of Bitcoin is essential for anyone looking to navigate the